How We Help You

Financial Wellness Coaching Services

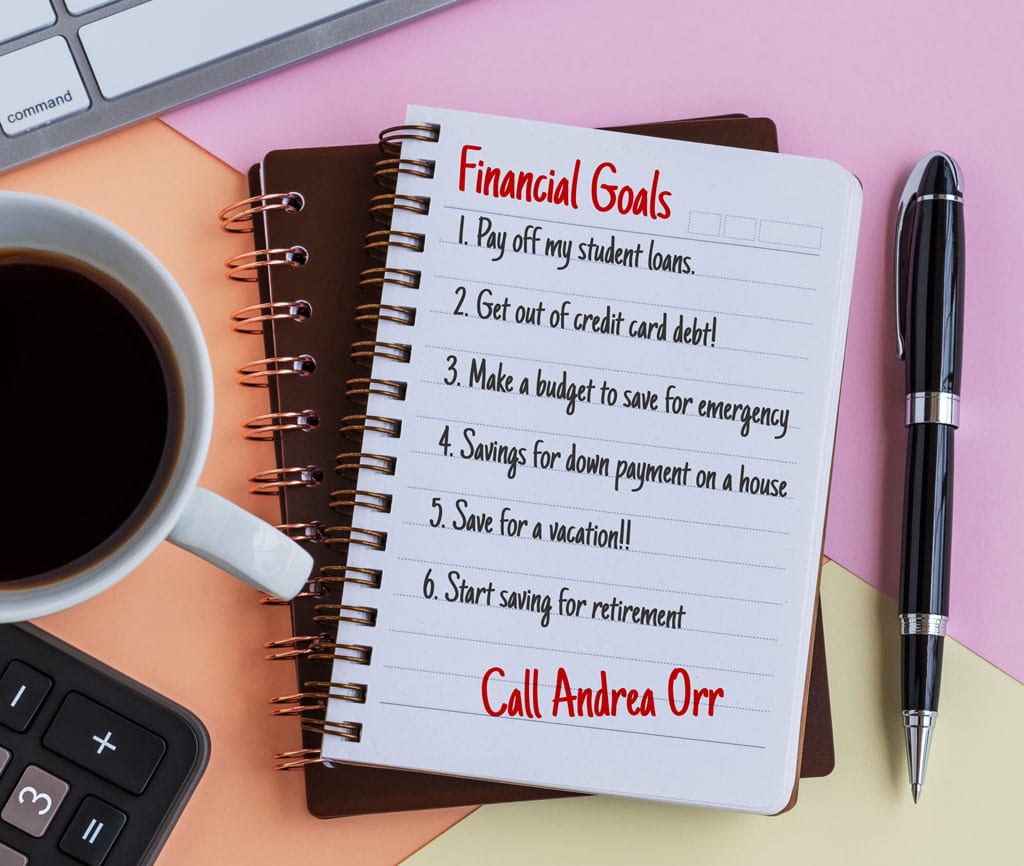

We will work with you at NO CHARGE in the general area of financial literacy. We want our community to know about:

Budgeting

Credit scores

How to plan a purchase of a car or a house

How to save for college/university

Or just a much needed vacation!!

These are just some of the areas that we will guide you through. Our network of professionals are ready to assist you with your individual needs. We have lots of ideas and tools that we will give you for FREE, while you enjoy our FREE WIFI. Bring your kids with you and we will share kid-friendly tools to put them on the path to Financial Wellness.

Consumer proposals

You don’t have to go bankrupt to be protected. If formal protection is what you need, our goal is to assist you in consolidating your debts into an affordable arrangement through a proposal to your creditors. We will arrange for all of the paperwork to be filed and will deal with your creditors directly. As long as the majority of your participating creditors are in favour of your offer (they vote based on the amount you owe them), it will become a binding agreement. As long as you keep up the payments and meet your duties the creditors are forever prevented from pursuing you.

Why choose a consumer proposal?

Before you choose bankruptcy, consider the benefits of a consumer proposal

A proposal offer is flexible – it can be a lump-sum payment, or can be done in periodic payments (usually monthly) for up to 5 years. The amount of the offer will depend on your income level and the value of your assets. Each situation is different and unique – we will review your details and come up with your best option. The three main benefits of a proposal over a bankruptcy are:

Formal protection from creditors

A formal filing will immediately protect you from:

Phone calls from collectors

Lawsuits or threats of lawsuits

Harassing letters

Scary threats from creditors

Frozen bank accounts

Garnishments by creditors

Garnishments from CRA

Formal filings would include proposal or bankruptcy. Only a Licensed Insolvency Trustee can file formal proceedings.

Personal Bankruptcy

Always a last resort, but sometimes bankruptcy is the best option to eliminate your debt.

Bankruptcy is always an option. Once you file for bankruptcy, you are protected from your creditors. That protection continues forever as long as you earn your discharge. If you don’t get your discharge, the protection will disappear and you will be responsible to pay your creditors. In summary, the most important part of the bankruptcy process is getting discharged. The process is different for everyone. Here is a summary of the differences:

- Length of bankruptcy – for a first time bankrupt, the length will be between 9 and 21 months. For a second time bankrupt, the length is between 24 and 36 months. Both a first and second time bankrupt are eligible for automatic discharges at the end of the bankruptcy period, which means you only have to deal with your Trustee’s office, not the Court. For three or more, the Court decides on the discharge terms.

- High income tax debt (if $200,000 or more and represents 75% or more of the total unsecured debt) can affect the length of the bankruptcy and the amount of required payment to earn a discharge. The Court will decide on the discharge terms.

- The amount that you will be required to pay in your bankruptcy to earn your discharge will depend on your unique situation – the income of your household, the number of dependents, alimony/spousal support payments, medical and child-care costs, and whether or not your spouse is willing to disclose his/her income are all factors that are considered.

- If you have equity in your assets, your discharge can be affected. This amount has to be collected by your Trustee either by selling the asset or by making payment arrangements to collect the value. Many assets are EXEMPT from seizure under various federal and provincial laws. It is important to speak to a Trustee to know exactly what equity (if any) you have in your assets. A detailed review is needed.

Learn more details about the bankruptcy process or contact us today and we will explain the consequences for your particular situation. Remember, meetings with us are always free of charge.